RICS HomeBuyer Reports (Level 2 Surveys)

Our Surveyors have undertaken thousands of RICS HomeBuyer Reports over the years

Get an instant quote

If you’re purchasing a property, you will most likely want the peace of mind that it is a sound purchase and investment free from defect and issue.

An RICS HomeBuyer Report, also known as a Level 2 Survey ensures that you’re fully aware pre-purchase of all of the defects and issues that exist within the property.

The report ensures that an RICS Qualified Surveyor inspects all facets of the property and then compiles his findings in a comprehensive and thorough report designed by the RICS in a traffic light format for ease of following and reading.

What Does a Surveyor do during an RICS HomeBuyer Report (Level 2 Survey)?

The Surveyor’s role will be to comprehensively inspect all parts of the property both externally and internally.

Their aim will be to identify every defect that exists to the property and then determine the cause, thereby presenting the client with objective advice on how to rectify the issue.

The outcome of the Surveyor’s inspection will be a robust report setting out all of his or her observations and ultimately fully informing the property purchaser in advance of the exchange of contracts or completion.

The RICS HomeBuyer Report (Level 2 Survey)

Condition Rating System

Whatever the condition rating is, here at Stokemont you will be sure to get reasoned and practical advice to best address and overcome the issue.

Condition Rating 1: Green

This means that there is no repair currently needed – It’s the best outcome!

Condition Rating 2: Amber

This means that the item being inspected has a defect that requires repairing or replacing. However, it is worth noting that the defect is not considered to be serious or urgent. – This is a medium rating confirming that the item may need attention at some point in the near future.

Condition Rating 3: Red

This means there are defects that are serious and/or need to be repaired, replaced or investigated urgently – This is the worst rating possible and will mean urgent attention and likely cost is required.

Stokemont’s Cost Ratings

To help you gain an informed understanding of cost in respect of each defect and issue our Surveyor’s locate. We include a cost rating chart setting out likely cost in an easy to follow: Low, Mid & High rating system.

We’ve classified these ratings as follows:

Low Cost

These are costs towards the lower end of the spectrum. We’d classify these as less than £1,000.00.

Mid Cost

These are costs towards the mid end of the spectrum. We’d classify these as £1,000.00 – £5,000.00.

High Cost

These are costs towards the upper end of the spectrum. We’d classify these as more than £5,000.00.

Stokemont’s top 5 Common Property Defects Noted over the Years

Damp

Damp is by far one of the most common defect our Surveyor’s locate on a daily basis. This defect can cause severe issue if it isn’t addressed. With costs of repair, nuisance and decorative remedy required, this isn’t a defect to miss!

Subsidence

Property Subsidence causes can be far and wide and related to a vast array of causes. With decorative making good and repair costs being substantial, ensuring the property is clear of this defect is imperative.

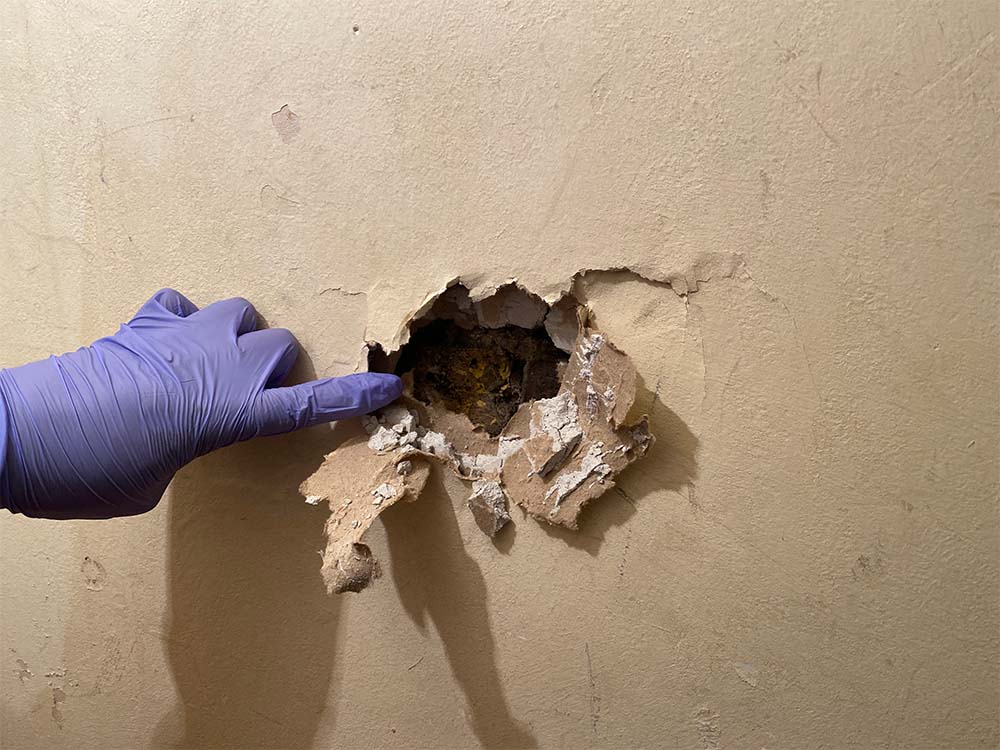

Pests

Ranging from woodworm, wood boring beetles, wasps and even birds! Pests can take many different forms. Woodworm and Beetles can quickly work their way through the wooden fabric of the property, causing irreparable damage and costly replacement.

Roofs

Defective roofs can be as simple as changing the covering, however can also be more sinister requiring structural support and even replacement. Roofs tend to be one of the most frequently ignored parts of the property. Ensuing you’re abreast of any issues pre purchase is imperative.

Façade Issues

With common issues such as spalling brickwork, damp ingress, bridged damp proof course, or blown render. Repairs can be costly and easy for an untrained eye to miss. Ensuring your clear of these defects is a must for any homebuyer.

RICS HomeBuyer Report (Level 2) Surveying Costs

Here at Stokemont, we believe that RICS HomeBuyer Report Surveying costs should be transparent and clear.

We have an Instant Quote Feature that will enable you to get a fixed cost quotation, confirmation of timings and will enable survey booking.

Why Choose Stokemont as your Level 2 Surveyor

No generic report creator tools

We don’t use automated software to create our reports. Each and every report is dictated on site from start to finish by the Surveyor. While this takes longer to do, we believe it is the only way for Surveyors to truly complete a thorough and bespoke survey based off the facts that they find.

We don’t rush the inspection

We take our time during our surveys. Our Surveyors’ diaries are structured off the task at hand ensuing that they aren’t having to rush the inspection to move onto the next job. We don’t overload our Surveyors with consecutive inspections, this ensures they have the time to complete a thorough inspection and survey every time.

Attention to detail

We take great pride in ensuring our approach to the inspection and subsequent Surveyor report is detail driven. We will advise you of each and every aspect of the property that will result in cost for you as an incoming owner. This ensures you’re fully abreast of the facts, risks and costs.

Typical RICS HomeBuyer (Level 2 Survey) Report Surveying Questions & Video FAQ

Closed

Will the Surveyor inspect both inside and outside of the property?

What should I do if the Report identifies defect?

We would advise in speaking with the Surveyor who prepared the RICS HomeBuyer Report to discuss his or recommendations.

We would advise in speaking with the Surveyor who prepared the RICS HomeBuyer Report to discuss his or recommendations.

If the defects are low risk and easy to rectify. At this stage, we would advise going back to the seller alerting them to the Surveyor’s findings, and ultimately renegotiating the agreed sale price to take account the repairs needed.

If the defects are of a major concern, it may be appropriate to reconsider proceeding with the sale.

Why do I need an RICS Homebuyers Report?

The RICS HomeBuyer Report will see a qualified and experienced RICS Surveyor visit the property in advance of the exchange and completion taking place.

The RICS HomeBuyer Report will see a qualified and experienced RICS Surveyor visit the property in advance of the exchange and completion taking place.

The survey ensures that you are fully informed on all the defects to the property, enabling you to make a fully informed decision as a purchaser, avoiding any nasty and costly defect surprise once you are the legal owner.

Will the Surveyor be Qualified?

Can I Be Present During the Surveyor’s Inspection?

During the survey itself the surveyor is going to want to apply his full attention to the issues and defects that are being located and ensure that he can complete that without any distraction.

Whenever we complete a report we always welcome our clients to have a full discussion with us upon its receipt as we find that that best aids understanding of the issues and gives them the full facts to then go back to the seller to inform them of their surveyor’s findings.

Will The Surveyor Check for Damp?

In the event that damp is located which is altogether quite common the surveyor will put forward their professional opinion as to what is causing that damp along with the necessary rectification requirements and likely costs in that regard.

Pre Purchase Surveys - Why Should I Select Stokemont?

This costs rating system assesses the defect located in a low, mid and high category.

The aim here being that you are fully informed of what the realistic remedy costs are going to be to make good the defect the surveyor locates.

As a firm we are building surveyors at our core and fully understand the defects and issues that can exist to all different types of properties whether that is a house, maisonette or flat. This experience ensures that you are in safe hands when it comes to purchase surveying requirements.

How Long Does It Take To Get My RICS HomeBuyer Report?

Here at Stokemont we can generally get inspections booked into the diary within 2-3 days of instruction.

Here at Stokemont we can generally get inspections booked into the diary within 2-3 days of instruction.

Once we have inspected, we then aim to have the report with you within 2-3 days.

Overall it is about a one week turnaround.

We fully understand that the purchaser is going to want to know the full facts as soon as possible and therefore we have got a tried and tested procedure in place to enable prompt turnaround.

What Are Common Defects?

When it comes to inspecting properties there are never any two that are alike however that being said there are typical defects that our surveyors regularly find.

When it comes to inspecting properties there are never any two that are alike however that being said there are typical defects that our surveyors regularly find.

These tend to be issues such as damp, pest infestation, subsidence or defects that result in disrepair.

Whenever an issue is located the surveyor is always going to fully explain where it is, what is causing it and importantly what needs to be done to rectify it along with the likely costs for rectification.

The aim here being that you are fully informed of exactly what you are purchasing into and the necessary action you will need to take should you become the new property owner.

Can The Surveyor Discuss His Findings with the Selling Agent or Seller?

Yes, we are very happy to discuss our findings with either the seller or the agent directly.

Yes, we are very happy to discuss our findings with either the seller or the agent directly.

Prior to doing this we would advise that the report is shared with those respective parties to ensure that they are fully abreast of the surveyor’s findings.

If they do indeed have any enquiries in respect of the report’s outcome discussion with the surveyor is always a good way to ensure that all parties are on the same page and fully understand the implications and outcomes of the report and issues found.

What Happens If I Don’t Proceed with the Property Purchase?

Unfortunately there can be scenarios whereby the outcome of the surveyor’s inspection, report and cost implications of the defects located, can put buyers off from purchasing the subject property.

Unfortunately there can be scenarios whereby the outcome of the surveyor’s inspection, report and cost implications of the defects located, can put buyers off from purchasing the subject property.

If indeed that happens to be the case, we would gladly offer any discount on any further surveys that we are instructed to undertake on any new properties that you locate and go through the purchase process for.

See us in Action! These are some RICS HomeBuyer (Level 2 Survey) Reports we have been involved in:

Here are some RICS HomeBuyer Reports

(Level 2 Surveys) we’ve done in the past:

Vicarage Road, Sunbury-on-Thames, Surrey, TW16

The Stokemont Building Surveying team were very pleased to assist a new client with an all important pre purchase survey and RICS HomeBuyer Report of this semi detached cottage located in Vicarage Road, Sunbury-on-Thames, Surrey, TW16.

Timeline: 5 days

Park Hall Road, West Dulwich, SE21 8EH

The Stokemont Surveying team were very pleased to assist one of our clients with their pre purchase requirements and complete an RICS HomeBuyer Report of this purpose built ex local authority property on Park Hall Road, West Dulwich, SE21.

Timeline: 4 days

Waldo Road, Kensal Green, NW10

The Stokemont pre purchase Surveying team undertook a complex RICS Homebuyer Report pre purchase survey of this mixed use, turn of the century property in Waldo Road, Kensal Green, NW10. With damp, asbestos and pest issues, this was a challenge!

Timeline: 6 days

Team Qualifications

Our team of surveyors are not only highly experienced but importantly they are also qualified.

We’re proud to confirm our surveyors hold membership status and accreditation to some of the world’s leading professional governing bodies including; the Royal Institute of Chartered Surveyors (RICS), the Chartered Institute of Arbitrators (CIArb), The Chartered Association of Building Engineers (CABE) and the Pyramus and Thisbe Club (P&T).

Advice Centre

Level 2 Surveys versus Level 3 Surveys, What’s the difference?

We are going to be taking a look at pre purchase surveys and the differences between those. A typical question we’re asked by property purchasers is what is the difference between a level 2 or level 3 survey. What’s the difference? In short, the only difference is the...

Home Survey Surprises

In this article, we are going be looking at the options that are open to a property buyer if their pre purchase survey, or RICS Home Survey flags up issues that they weren’t aware of. DON’T PANIC First and foremost, don’t panic. It’s very usual for property surveys to...

What is a Pre-Purchase Survey?

Hello and welcome to today's installment of our property surveying blog post. In today's blog, I am going to be discussing building surveying matters, specifically looking into what are pre-purchase surveys. A pre-purchase survey is something that you can choose to...